Data.

Data is a powerful thing.

When tasked with scanning the universe to select an investment strategy for clients, there are a lot of choices and the data is crucial to rely upon.

In this blog I'm going to outline some FACTS about mutual fund performance, fees, and long term trends.

There are thousands of mutual funds in the U.S., running strategies ranging across the spectrum. Many strategies aim to replicate hedge-fund-like management and some may be similar to stock-picking or options trading, while others are just passive buy-and-hold strategies. Because mutual funds must be transparent in their fees and performance (hedge funds and other structures can be more vague), we can screen the data provided by these mutual funds to help draw inferences about all investment strategies, in general.

Remember, if some up-and-coming manager builds an amazing algorithmic model for buying stocks, the deep pockets of Wall Street will swoop in with a big payday and have them replicate the strategy for them. Mutual funds are a good representation of the market.

If you're short on time and want to watch a quick video on this subject rather than read this email, here you go.

Okay, let's get into it:

The chart above shows something interesting:

Over the last 10, 15, and 20 years, only about 20% of stock mutual funds beat their index benchmarks. This is why low cost index funds have become so popular. If beating the index is unlikely, at least just try to track it.

Further, if you bought a fund 10, 15, or 20 years ago there's a very good chance that it isn't around today.

...Why is that?

Because past performance is a tool used to.help sell potential investors.

We all know that past performance is not indicative of future results, but these marketers know that a bad track record is hard to overcome. When a fund has bad performance, they often shut the doors or migrate the failing fund into a different fund run by the same firm.

Remember, these mutual funds are operated by armies of PhDs, CFAs, and the best and brightest analysts and portfolio managers in places like this:

The resources of big firms in the photos above aren't always a good indicator of investor success.

If you're a long term investor, you'd ideally like to choose something you can adopt and stick with. But if you chose a US Equity fund at random 20 years ago, there's only a 41% chance you'd choose a fund that is still around, and only a 22% chance that the fund beats its benchmark index.

Here's where things get interesting.

The winners are indeed rare, but is there a way to find them in advance? A common method is to use past performance.

Let's explore that...

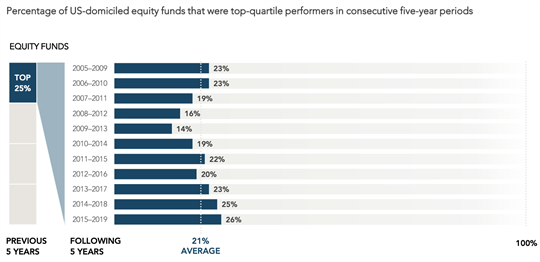

The above graphic shows that US stock funds that were in the top 25% of performers for 5 years were only in the top 25% of performers for the next 5 years about 21% of the time, on average.

So if you planned on reviewing the best performing funds over the last 5 years to make a decision about your investment plan for the future, it's almost as if good past performance should be avoided.

Of course, it's not quite that cut and dry, but past performance certainly should not be relied upon as a single determinant of a fund's merit.

However, you can make some broad assumptions based on an investment's expenses: higher expense funds tend to underperform...

Here's the data:

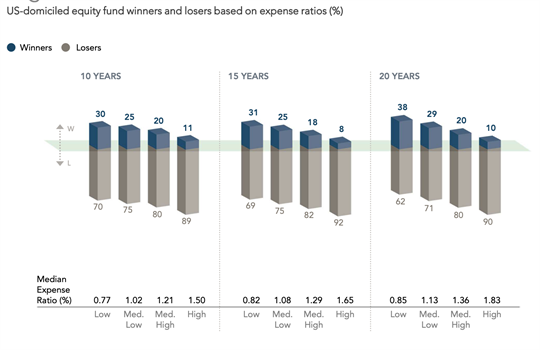

The above image shows one key thing:

The more expensive a fund, the more likely it was to have underperformed its benchmark over the last 10, 15, and 20 years.

Additionally, the more internal trading a fund does, the less successful the funds have been, on average.

So here are our findings:

Outperforming funds were in the minority.

Strong track records failed to persist.

High costs and excessive turnover may have contributed to underperformance.

Managers attempting to outguess the market may incur high costs that raise the barrier to outperforming an index.

Successful fund investing involves more than picking a top-performing fund from the past.

When picking funds, consider investment philosophy, robustness in portfolio design, and attention to costs, among other factors. I rigorously screen through findings like these to help choose funds for both client portfolios and my own.

I really value mutual funds in a sophisticated strategy, but many of them aren't right for a sound financial plan. Like financial advisors, there is a broad difference between the good ones and the bad.

If you have questions about this or anything else, just ask.

Be well,

Adam

480-205-1743