Gamestop

Greetings and thanks for reading my blog. We're going to talk a little about Hot Stocks this week, but before I get into that....

As of this writing, it's about 1pm on February 19, 2021 and I've already broken my 2021 New Years' Resolution.

That resolution: To send out this emailed blog/newsletter consistently.

At the beginning of the year I'd set a goal to send one blog per week to cover an important subject or recent trend. It's been nowhere close to that...As the saying goes, You Plan, God Laughs.

You see, shortly after the beginning of the year we came down with COVID (thankfully, everyone's recovered and healthy) and, once healed, I began the process of going through annual meetings with existing clients (as per this Client Service Calendar). Sometimes something has to give -- the newsletter/blog was IT.

So here's thing: I'm starting a new resolution... A new grand proclamation. Are you ready for it?

I'm setting a goal to send one blog per week to cover an important subject or recent trend that I believe is worth attention.

...So, yea, the same goal I originally had. It will hopefully be easier to stick with now. We're going to shoot for sending this out every Friday.

Additionally, maybe you have questions about something you're hearing about -- I would love to make sure these questions are addressed; if you are curious about something, odds are that some of the other recipients of this newsletter (about 1,500) are interested as well. Please don't hesitate to reply with a question you may have.

With that out of the way, below is this week's topic. ... Enjoy!

--Adam Harding

CERTIFIED FINANCIAL PLANNER

Dave Ramsey Smartvestor Pro

Owner @ Harding Investments & Planning.

2021 got off to kind of a weird start..

Of course, I mean the "Meme Stocks" have arrived.... and then they left almost as quickly as they came.

If you're a sensible person you may be asking yourself right now, What on earth is a 'meme stock'? ..

Recently, the craziness in the market with Gamestop, AMC Theaters, Nokia, etc. was due to the collective social-media-based organization of individual traders to drive up the price of these (seemingly) inevitably-defunct companies. The viral trading nature of these stocks is what coined their connection to memes (i.e. highly shared pieces of content on the internet). People hyped them up to drive up prices -- they've since retreated almost as quickly as they rose.

The whole "Gamestop thing" was interesting and entertaining, but it didn't really affect my outlook, guidance, or the people we work with at Harding Investments & Planning....Most people saw it as short term noise.

I'm not going to spend anymore time on Gamestop because, frankly, it's just a kind of funny story that captivated headlines for a few days and it's no longer relevant to what I believe matters most for you.

(But if you'd like a little more depth, here's a quick PDF to contextualize some of this situation: Article )

Moving on, a more substantial trend has emerged and sustained over the last several years. I've addressed this in blogs before, but it merits continued attention.

That trend: The Rise of Tech Stocks.

We used to call these stocks the "FAANGs" which stood for Facebook, Apple, Amazon, Netflix, and Google. But with a new year comes a new acronym -- plus, we have to add Microsoft into the mix due to the nice run it's had. Let's test some of these acronyms out:

#1) GANFAM

#2) MAFGAN

#3) FANMAG

... I think we'll go with FANMAG for now.

Now that we're committed to our fancy new "FANMAG" acronym, we can acknowledge how Facebook, Amazon, Netflix, Microsoft, Apple, and Google all substantially outperformed the US stock market1 in the eight calendar years that they have all been public companies (Facebook went public in May 2012).2

Emerging as winners from among a large number of companies that fared less well during 2013–2020,3 these juggernauts outpaced most of their surviving peers with annualized outperformance versus the US market ranging from 7.31 (Alphabet) to 42.58 percentage points (Netflix), as shown in the chart below.

The chart above shows something interesting: how a relative few companies on the right side of the distribution amounted for a huge amount of the performance above the US Market average. In fact, you can see that there are far more underperforming companies on the left side below the X Axis than there are on the right.

Understandably, the good FANMAG performance captivated investors and dominated headlines during 2013–2020. However, a more complete picture emerges when accounting for the many companies whose investors were less fortunate over the period.

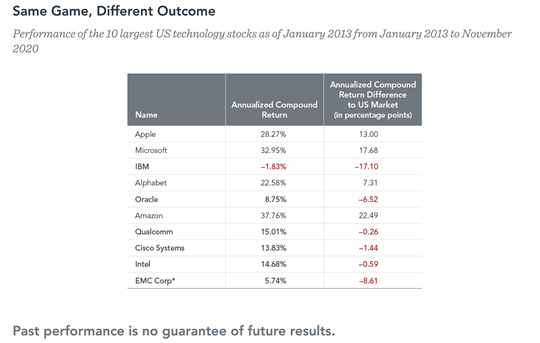

As shown in the chart below, of the 10 largest US technology stocks as of January 2013, all but Apple, Microsoft, Alphabet, and Amazon underperformed the US market over the same period. Simply put, if you were just choosing one of the top 10 tech companies at random in 2013, there was a 60% chance you'd have chosen a stock that trailed a simple US Market Index Fund.

Again, if you were blindly choosing a top 10 tech company in 2013, there's a 60% chance that you chose one that underperformed the market over the next 7 years. Of course, this is where hindsight biascreeps in and has you believing that you would have certainly only chosen Apple, Amazon, Google, or Microsoft --and maybe you would have, but maybe not.

For a little more context, the chart below shows the hypothetical growth of wealth for an investor who put $1 in each of the 10 largest technology stocks and the US market in January 2013. While the $1 invested in Amazon and Apple, for example, would have grown to $12.63 and $7.18, respectively, by November 2020, the returns of non-FANMAG tech stock contemporaries would have failed to even surpass the US market.

The returns of these FANMAG stocks absolutely stand out. However, the range of individual stock outcomes has often been notable.

A historical look shows that FANMAG performance has been quite ordinary. You see, there is often just a handful of companies which drive a disproportionate amount of gains in the market.

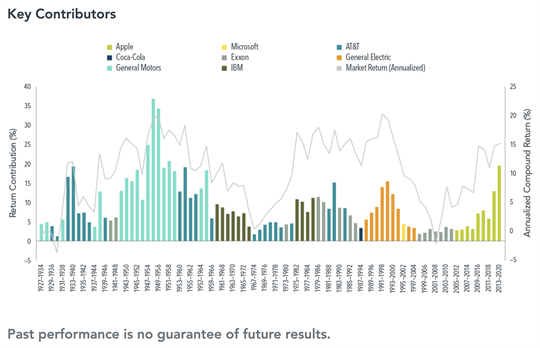

Drawing on stock return data since 1927, the chart below indicates that historical top performers often experienced larger outperformance relative to the US market than the FANMAG stocks realized during 2013–2020.

For example, Apple’s 2013–2020 annualized excess return of 13.00 percentage points places it at the 93.67 return percentile among all US stocks that were trading in January 2013 and survived the eight-year period that followed. However, the average outperformance of stocks at the 93.67 percentile over eight-year rolling periods from 1927 to 2020 was 15.60 percentage points, or about 2.60 percentage points higher. With the exception of Netflix, the same holds for the other FANMAG stocks, with historical outperformers at the same return percentile outperforming the market by more than the FANMAG stocks did in 2013–2020. Put succinctly, if history was an exact predictor of the future (it's not, of course), we would have expected these stocks to actually do better than they did.

Again, this just shows that stocks that tend to be in a top percentile of the entire market have historically done better than these acronym stocks, with the exception of Netflix. As always past performance is not indicative of future results. BUT, I think there's real value in educating yourself about the past and using it to help contextualize some of the way you think about money.

A defining trait of the FANMAG performance is that these excess returns have come from among the largest companies in the US, implying they were meaningful contributors to the overall US market’s return. However, historical data show that this also is nothing new.

Defining a stock’s return contribution as its total return weighted by its beginning-of-period market capitalization weight (i.e. the value of the company as a proportion of the market), we see that Apple’s contribution to the US market for the period 2013–2020 was 19.68%. How does this figure compare to other top return contributors?

The next graphic below illustrates the top return contribution and the annualized US market return over rolling eight-year periods since 1927, revealing instances of return contributions by the likes of AT&T, General Motors, and General Electric that were comparable to, or even exceeded, that of Apple in 2013–2020.

Simply put, the biggest companies are not especially dominant today relative to how dominant big companies have been in the past.

The FANMAG acronym will eventually be replaced by another trendy name.

Perhaps you or your parents remember the "Nifty Fifty" in the 1960s and 70s, which was a set of 50 blue-chip stocks like Coca-Cola and General Electric.

More recently, the acronym BRIC, represented opportunities in the fast-growing emerging economies of Brazil, Russia, India, and China. The acronym was only commonly used when Emerging Markets had their incredible run over the first decade of the 21st century.

I wasn't that long ago that the WATCH companies—Walmart, Amazon, Target, Costco, and Home Depot—also gained traction in the market’s lexicon.

While documenting trends in finance is entertaining, there is little evidence that investors can spot these trends in advance in a way that would enable market-beating performance. Only after the trend has occurred do the stocks garner enough attention to merit a nickname.

Moreover, concentrated bets on high-flying stocks can expose investors to idiosyncratic risks (i.e. 'stuff that can happen to one company but not the entire market') and a wider range of possible outcomes. By contrast, a sound investment approach based on financial science emphasizes the importance of broadly diversified portfolios that provide exposure to a vast array of companies and sectors to help manage risks, increase flexibility in implementation, and increase the reliability of potential outcomes.

But if we must forecast the future, I suppose I'd like the next hot stocks to be:

H ome Depot

A lphabet

R adioshack

D iageo

I llinois Tool Works

N intendo

G eneral Electric

That's an acronym I can humbly get behind.... (But to be clear, I'm not recommending that you go buy these stocks).

Jokes aside, it’s easy to view the stories of market speculation that have dominated the news recently as cautionary tales for individual investors. So this is probably a good time to mention that investing and gambling are not the same thing.

If you’re not the type of person who feels comfortable betting your life savings on a long shot, the good news is that you don’t have to find the next Hot Stock to win in the stock market. Concentrating your whole investment on one or two companies means the stakes are high enough to expose you to unnecessary risk. Even if you manage to land a few big winners, my research has found that good luck is unlikely to repeat throughout a lifetime of investing. For every individual who got in and out of a hot stock at the right time, there’s another who bought or sold at the wrong time, and winners tend to be much louder than losers, which can make you believe winning is more common than it is.

I’ve always believed it's better to concentrate the bulk of investment strategy around betting with the whole market than on a few individual holdings, through a low-cost, highly diversified portfolio. Then let time and compounding do their work. If a relatively small portion of the portfolio gets invested in individual investments to try and capture alpha (returns greater than the market), so be it. But if it fails, the investor is insulated.

With all the options now available to investors, putting together a solid investment plan—one that you can stick with—is key. Markets have never been so accessible, and information has never been so widely available. And despite the fact that stories of stock-market gambling keep making the news, many investors have managed to enjoy growth in their investments using low-cost, highly diversified strategies like index funds.

Indexing has turned out to be a good solution for many people. For those who want more customization and flexibility, there are ways to build on the strengths of indexing while correcting for some of its weaknesses (notably, rigid design).

It’s always important to look at the big picture. A huge win on a stock bet today doesn’t mean much if you lose it tomorrow.

Investing is a lifelong journey made of several consecutive actions strung together. Making money slowly is much better than making—then losing—money quickly.

That's all for now, thanks so much for reading. Please reach out with any questions/comments/ideas for future writing or research.

--Adam Harding, CFP

Owner/Advisor @ Harding Investments & Planning