Market Observations

Last week, a Chinese startup called DeepSeek released a new AI model named R1. DeepSeek’s R1 model performed as well as the leading US AI models and only used a fraction of the resources. To put this in perspective: in terms of resources, this is like a high school JV basketball team walking into Duke’s Cameron Indoor Stadium and losing to Duke by 1.

Skepticism here is warranted, given the Chinese Communist Party’s track record of information transparency. We may look back in six months and see a different story.

Over the weekend, the world debated what the impact of a 93% more efficient and open-sourced AI model might mean for companies like Nvidia, Broadcom, and the entire Mag 7.

On Monday morning, investors woke up, had their coffee, and saw a large gap down in the technology-heavy Nasdaq. Nvidia, the largest company in the world, lost 17% of its market cap in one day.

WSJ Article for more on DeepSeek.

I’d like to use this opportunity to point out a few enduring market takeaways. Here are three insights to consider:

1. No Company is Bulletproof

Every company has a weakness—an event, disruption, or shift that can bring it down.

The more concentrated your position, the more exposed you are to risks unique to that business—this is known as idiosyncratic risk.

Right now, it's hard to imagine a world where the Top 5 companies Apple, Nvidia, Microsoft, Google, and Amazon aren’t dominating. But let’s do just that.

Let’s hop in a time machine and rewind 25 years. On the left is a look at the top 20 largest U.S. companies in the year 2000. Back then, these giants felt invincible, too.

After 25 years, not a single company in the top 5 remained in the top spots. Just six companies remain in the top 20. And only Microsoft—still holds a spot in the top ten.

The lesson? Dominance is often temporary. Innovation, competition, and disruption are always reshaping the market. No one knows who the future winners and losers are or where they will come from.

2. Companies Slow Down

I knew about Nvidia before Wall Street did.

Back in 1999, my brother and I were hooked on a computer game called EverQuest. To run it smoothly, you needed a top-of-the-line computer graphics card. We pooled together the money we made that summer, and bought the first Nvidia GPU ever made, the GeForce 256, for $200.

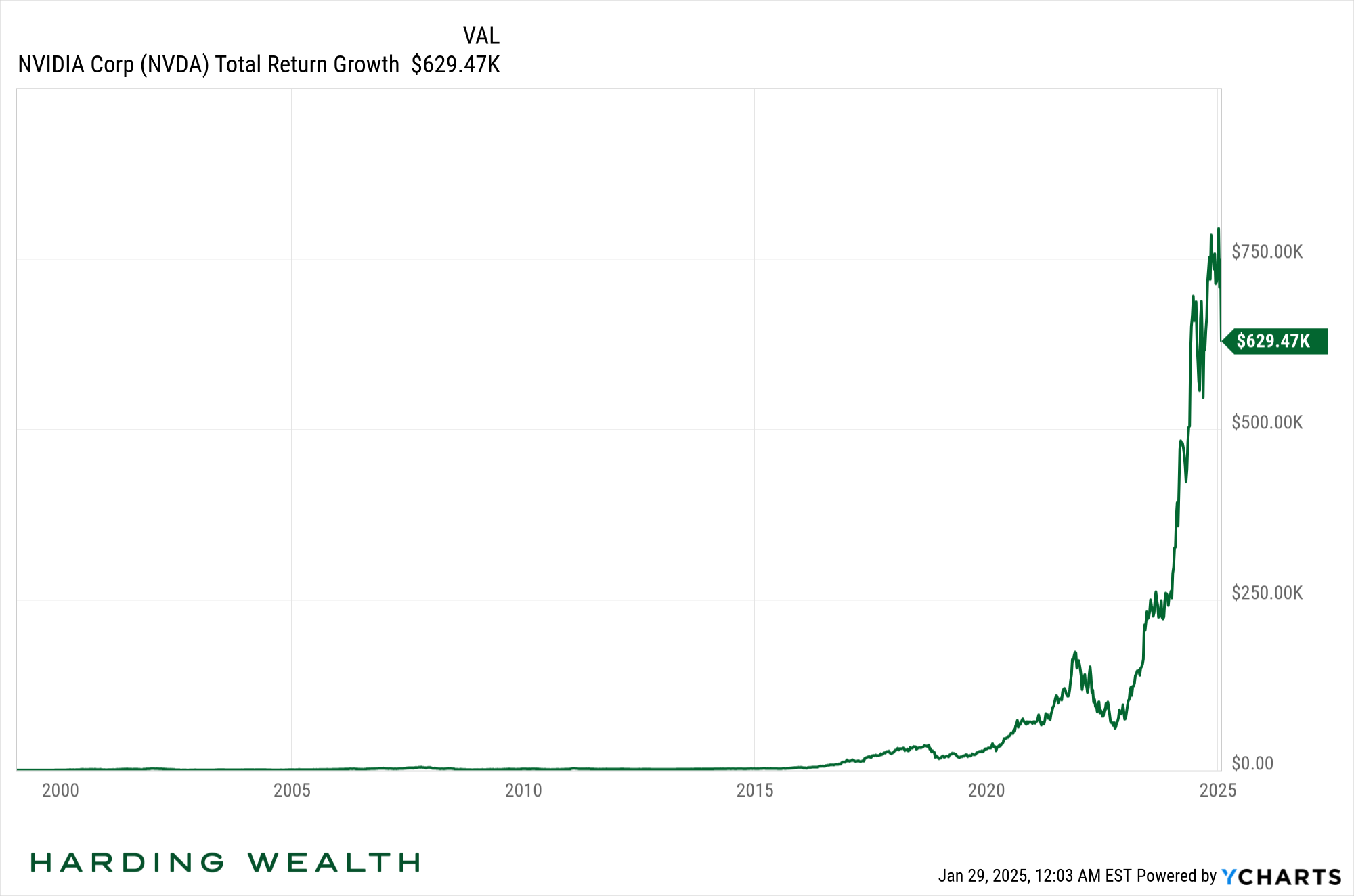

But what if, instead of buying the graphics card, we had invested our $200 dollars in Nvidia stock? Today, that investment would be worth around $630,000. Ouch.

Do you think investing $200 for 25 years in Nvidia today has the same growth potential it did in 1999? No, probably not—but let’s examine why.

In 1999, Nvidia was a relatively unknown company in an emerging industry. It had massive growth potential, benefiting from the rise of personal computing, gaming, and later, AI. Investors who got in early were rewarded as Nvidia became a dominant force in GPUs and expanded into data centers, AI, and autonomous vehicles.

Today, Nvidia is among the top three largest companies in the world, with a market cap in the trillions. While it may continue to grow, the law of large numbers makes it harder to achieve the same percentage of gains. A small company can 100x; a trillion-dollar company doubling is already a challenge. This is the size premium.

Now, to be intellectually honest, I thought it would be difficult for Nvidia to double again when it reached a $1 trillion market cap, and it did so in three months.

With this growth comes even greater expectations, and those expectations are now embedded in the stock price. Because valuations for top technology companies are so high, they must sustain rapid growth to generate meaningful investment returns. Any sign of slowing momentum can rattle the market—just as we saw with the release of DeepSeek, which exposed how fragile that growth narrative can be.

Here’s a interesting research piece from Dimensional that shows a clear pattern: Companies tend to deliver their strongest returns before they break into the Top 10. Once they reach the Top 10, their performance often lags the market return moving forward. In other words, companies tend to slow down.

3. International Diversification

We use international diversification in our portfolios. And it has sucked to hold that compared to being fully concentrated in the US… but that suck is what diversification feels like.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be out performers. How should we deal with this uncertainty?

First, by realizing it is difficult, or impossible, to predict a country’s returns by looking at the past. In the past twenty tears, annual returns in 22 developed markets varied widely from year to year. Check out this country tapestry of annual market returns (each color represents a different country, and each column is sorted top down, from highest-performing country to the lowest.)

Past performance is no guarantee of future results.

From 2004 - 2023, Denmark had the highest annualized return of any country. The US finished second in annualized returns, but only finished first in the country rankings once over that period of time. In eight calendar years, it was in the lower half of performers.

After 15 years of US outperformance, the sentiment on international equities is near rock bottom. Here’s the argument, “what could cause the US to go down, that wouldn’t cause even more harm to the rest of the world?”

Here’s one potential outcome. If the AI speculation goes bust, will we get meaningful outperformance in the international market compared to the US? The global market is less leveraged to large technology companies than the US.

Closing Thoughts: Develop a Guiding Set of Beliefs

As an investor, you need a guiding set of beliefs that tell you how to make decisions in all types of environments. Here’s what ours are:

Investments should produce value while you are holding them. This is why we steer away from bitcoin, gold, and other commodities.

The best way to achieve your outcomes is with the least amount of risk needed. This steers us away from concentrated positions and towards diversification.

We accept the current price of securities. We do not look for opportunities to out guess the markets collective wisdom.