Monthly Market Wrap — April 2024

… And just like that we’re a third of the way through 2024.

For stocks we’ve seen a great first quarter and a bit of a subsequent pullback in April. As of 4/30/24 we’re about 4.16% down from the stock market’s high.

While April was a bit rough for large US stocks (the S&P 500), it was even worse for small US stocks who registered a 7% decline.

However, Emerging Markets registered an upward gain (0.74%) — a win for the proponents of global diversification.

Below you can see the April 2024 performance and trailing 12 month performance of several equity market asset classes.

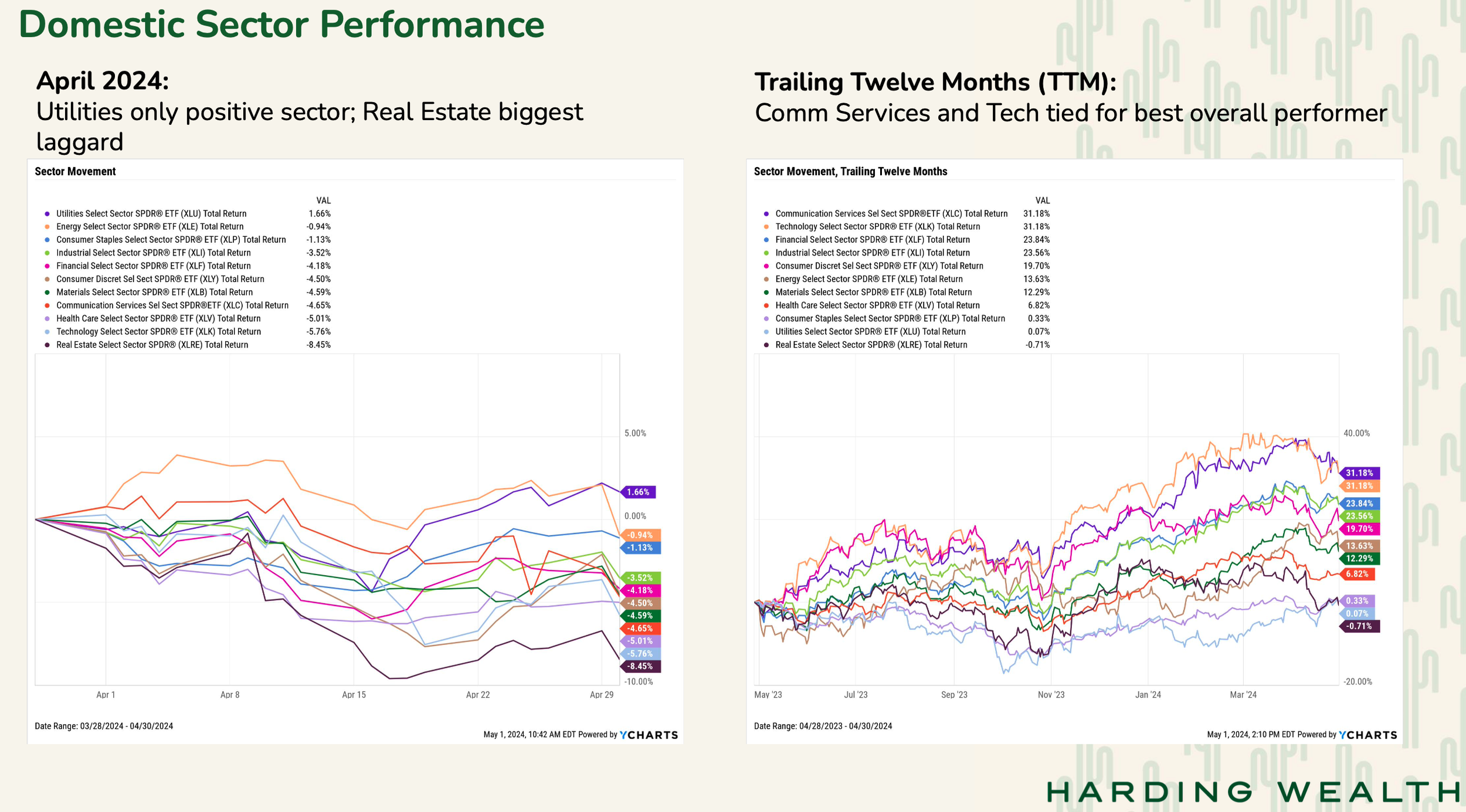

In April, every sector of the US stock market declined aside from Utilities.

For the last 12 months, utilities (along with real estate) have held the bottom rung of the performance spectrum.

Before moving on, let’s spend a minute on recency bias:

Let’s pretend you and I are casually discussing a future investment you’d like to make. I suggest “technology stocks” and you look up the last 12 months of returns (the orange line on the upper right chart) and see they’re up 31%.

You think I’m smart for this suggestion because that would have been a great idea 12 months ago…. But that’s not what you should care about. You should care about what happens 12 months — or twelve years — from now.

Contrarians see the chart above and want to buy real estate. Momentum investors see the charts above and buy tech. Neither approach always works, but buying things which have recently underperformed (or selling recent top performers) is harder to implement than the chasing recent returns. Choose wisely.

On to interest rates….

Below is a visual comparing the last decade of inflation to the Federal Reserve’s target rate.

The 5.50% Federal Funds rate above is the most important macroeconomic factor most of our clients are managing today. This rate trickles throughout the economy, affecting everything from mortgage rates to high yield savings accounts.

This 5.5% rate is why the current APR on our preferred high yield savings account is 5.1%*.

Yes, higher rates can slow the economy and impact real estate prices, but they also allow investors to capture yield on relatively safe investments.

*Our current High Yield Savings account for clients is Altruist Cash. Send us a message to learn more.

Thanks for reading this far. There are several more insights within the full report (including observations on Gold, Housing, and more).

Enter your email below to receive the full report

That’s all for now.

Onward,

Adam Harding | cell: (480) 205-1743

Advisor & Chart Guy

www.hardingwealth.com

For educational and informational purposes only. Past performance is not indicative of future results.