One Hundred Million Dollars.

This is the estimate of how much salary Tom Brady left on the table to help free up more team salary to build a great roster to help win Super Bowls and solidify his legacy.

One.

Hundred.

Million.

Dollars.

In his years with the Patriots, Brady took less money than a player of his stature could have otherwise deserved. Just last week he signed another team-friendly deal with Tampa Bay after winning the Super Bowl last month. He wants to win and he knows his team only has a fixed amount of resources to make that happen. For many, this is an unfathomable sum to leave on the table.

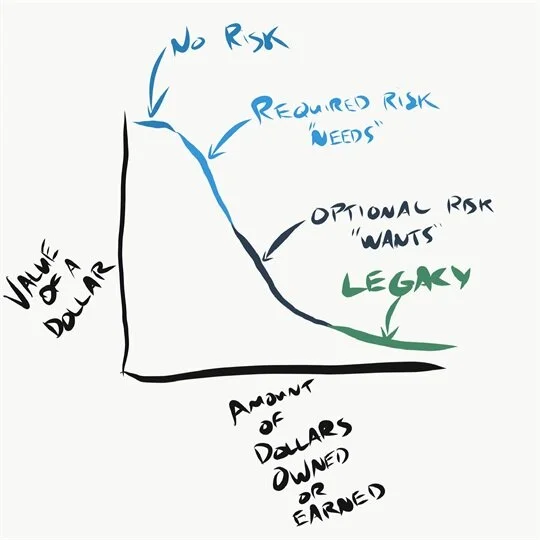

However, moves like this are about more than just being a team player... We know they're about solidifying his legacy by winning. But in nerd-speak (my native language), they're about the diminishing marginal utility of a dollar. Here's what I mean:

Most things become less valuable to you as you get more of them.

Take bananas, for example:

If you have one banana you're pretty happy with that banana and you're looking forward to eating it.

If you have 2 bananas you're slightly less happy about the second banana.

If you have 100 bananas, you can't stand the idea of eating another banana and you're likely to start giving them away.

Dollars, like bananas, diminish in value (utility) to their owner as the owner gets more of them. As investors, how valuable dollars are to us is a big dictator in how much risk we feel we can take with them.

Here's a sketch I put together to highlight this relationship:

The first dollars we have are for the things we need in the short term --or to protect ourselves from unexpected events. We value these dollars the most. We don't take risks with these dollars because we almost immediately exchange them for the stuff we need to buy or we park them in an emergency fund to protect us against the unexpected.

As we get some extra dollars above what we need in the short term, we start to look to the future when we may not have a steady income to be able to buy the stuff we require or to protect against emergencies.These dollars are also crucially important because we realize those same life necessities we buy now will likely cost more in the future (inflation), so some amount of investing is a necessity. The risks we take, however, can't be too high with these dollars; we can't risk not meeting the goal of Long Term Financial Security.

If current needs are met and retirement reserves are funded, then it's time to come up with some "wants".... Let's use a sports car as an example:

You want the car but you don't need it, so your investments can reflect that it's okay if it doesn't work out. Investments with this characteristic often end up being considered high risk.... If the investment doesn't provide a good return you'll still be able to put food on the table. Buying the car would be a nice option to have, but it's an option nonetheless.

We know that risk and return are often closely related for the long term, disciplined investor (more risk = more return potential). The fact that you don’t need these dollars because they're for something you "want" means you can take more risk with them... The cycle can look something like this:

More risk ➡️

More growth potential ➡️

More dollars you don’t need ➡️

...More risk ➡️

(and the cycle goes on)

The fact that some investors do not need these funds is the primary reason they can take risk with them. Then that risk often ends up leading to more dollars they don't need. This is the condition many of our clients end up with -- they can't possibly populate a long enough list of "wants" to offset theirassets.

When the circumstance in the above paragraph is met, you become Tom Brady (perhaps a little less wealthy, but hear me out). You have what you need and want, so you're willing to risk dollars for something else.... Legacy.

"Legacy dollars" are the goal for myself and most of our clients.

...You can give them away for a "100% loss" of the dollar in nominal terms, in exchange for the benefit of feeling a certain way in support of a cause (like a donation to charity).

...You can leave them invested in a long-term, high-risk growth strategy to build generational wealth for your heirs.

...You can take zero risk if you feel you "have enough" and investing causes you to lose sleep.

Legacy dollars come with almost no rules and ultimate flexibility. If approached the right way, these dollars can have the most impact on the way you feel and the world around you.

If you're not there yet, that's okay. We're all on the same path, let me know if I can help.

That's all for today.

Onward,

Adam Harding