100 Million Dollars Part 2

Earlier this week I shared a different post titled One Hundred Million Dollars (here it is if you didn’t see it).

That post was about Tom Brady’s hundred million dollars….This one is about yours.

Harding Wealth recently surpassed $100,000,000 in assets under management and it’s both a big deal and not a big deal all at once.

You see, investment firms are measured in a kind of dumb way. That dumb way = Assets Under Management.

Why is it dumb? Because managing a large amount of money does not infer competency, care or proof that clients are better off as a result of their involvement with the firm. After all, Bernie Madoff managed billions for clients, only to end up stealing from them. I’ve seen big firms with serious flaws and small firms I would trust with my own wealth.

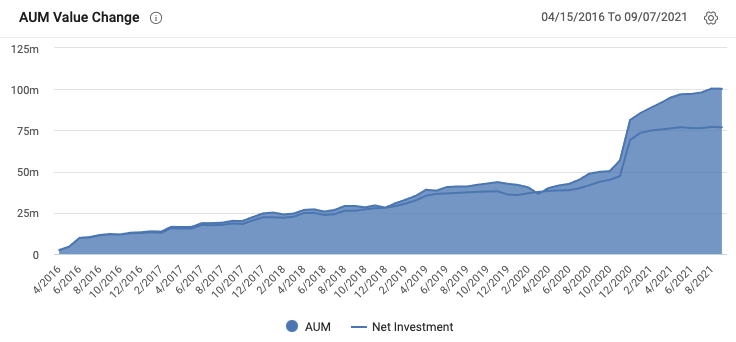

Before I get into why it is and isn’t important, here is the growth pattern of the firm over the last 5 years.

*As of September 2021

Our growth has been steady, which I’m proud of, but last year we saw a pretty significant growth rate.

I believe the reason for this spike is fairly straightforward:

Fiduciary wealth advice becomes more valuable when things are chaotic… and 2020 certainly was chaotic.

We also grew because our clients were disciplined. They didn’t panic and they stayed the course. We grew because of their (your if you’re a client) continued trust.

What is good about $100,000,000

Okay, so there are a few things that are good about $100,000,000 in assets under management. Here are some of them:

The most important thing about any kind of consistent growth trajectory is the implication that people trust you. We have very low, almost nonexistent client turnover, which is everything for our business. Clients have shown trust in not only continuing to work with us, but also continuing to stick with the investment plans we’ve adopted. For me, this is by far the most important part of recognizing Harding Wealth’s growth.

When you break away to start a firm from scratch, there can be some nerves around whether or not you’ll survive. Quandaries like how to find clients or how to run the business can add uncertainty. I launched this firm in the spring of 2016 and in those early years, a handful of very trusting clients took the leap with a 30-something advisor operating as a one-man-shop at a firm in its infancy. Candidly, the firm isn’t that different today than it was back then, but being a little bigger might help new potential clients feel less like they’re taking a leap with a startup and more like they’re joining an established firm.

Investment advisory firms register with the state they’re located in (AZ for us) and with every state where they have more than 5 clients. When you hit $90 million in client assets, you’re eligible to begin registering with the SEC. When you hit $110,000,000 you must register with the SEC instead of the state. $100m is often a guide post for when we start to migrate that direction. We will make this transition within the next several months. Presumably, involving the SEC gives even more oversight of our operation (although the state of Arizona has audited us and done a good job so far) — I believe that more oversight helps protect investors from some of the bad actors in our industry.

Growing in size clearly has brought more resources for us to add infrastructure to our offering as well —and no addition was more important than hiring Cinnamon Martinez a little more than one year ago. She adds a lot of service and administrative support capacity to the technical investing and financial planning work I do. As I await the birth of my daughter this month, it’s a tremendous comfort to have Cinnamon’s help in keeping our organization running smoothly. We will keep looking at ways to add depth to what we do.

Lastly, being bigger means we can support a little more complexity within our operation. This month we added Charles Schwab as a place where we can hold and manage client portfolios (alongside our current relationship with Altruist). Eventually these two firms will merge, but for now we retain the ability to work with accounts at either place.

What is irrelevant about $100,000,000

Some of the best advisors I know don’t manage a lot of money — AUM alone should not imply competence. In fact, huge growth rates may often mean that an advisor is spending the majority of their time marketing the firm instead of working with clients or honing their craft.

I have access to the same investment strategies at $100m as I did at $1m… And back when I was at a firm which managed $700m we had access to the same strategies I have access to today. Being bigger does not affect strategy.

Remember when you had a goal to save your first $100,000 or $1,000,000? Then you hit that goal and what changed? Nothing….. This is a little bit like that, it’s just a number.

In business and in life, it’s actually pretty unfulfilling to focus on quantitative goals like $100m in assets or a $2m portfolio or $250k/yr in income or something like that. Getting to $100m has been more a product of helping people reach different goals with less of a direct financial figure. For example:

Talked a client through their estate plan, connected them with the right professionals to make trust/will adjustments, and ensured everything was titled appropriately.

Helped a client retire by optimizing social security payments and pairing that with their portfolio strategy.

Designed a plan for drawing down 529 assets to pay for children’s college.

Opened Roth IRAs for the children of a client and helped them make contributions based on their summer job earnings.

Helped a growing family understand the tradeoffs and resources required when buying into a bigger house.

Conclusions and looking forward.

I think the times when we feel most wealthy or successful are not round numbers or benchmarks, but instead are seemingly small moments. For me, that feeling happens when I’m not worried about what the tally will be at the grocery store checkout line or when we pay the bill for my son’s preschool with minimal stress — no Lamborghinis or luxury vacations needed to make me feel like we’re in a good place, just a few small moments to relish in being financially comfortable.

Similarly, feeling successful in this firm is not about hitting a round dollar amount, but instead it’s about being able to keep doing good work for clients whom we enjoy working with and who presumably feel the same way about us. To be able to answer my cell phone when clients call rather than filtering people through an automated call service — that’s what it’s about.

So, in summary, yea, I’m proud of the $100m milestone, but it doesn’t really mean anything. I suppose it’s a bit like trying to build up to bench press 200 lbs or run/walk 10 miles or something — The goal to hit that number is what pushes you through the day to day reps to get a little better over time, but when you hit that number it becomes clear that the actual thing that mattered was the process of ongoing improvement which got you there.

So, cheers to ongoing improvement in pursuit of relatively meaningless milestones.

On to the next one,

Adam Harding

Advisor | Owner @ Harding Wealth | Amateur Artist and Guitar Player

480-205-1743

Questions? Email, text or call anytime.