TAX THE RICH?

New York Democratic Rep. Alexandria Ocasio-Cortez's made a political fashion statement at Monday's Met Gala. The dress below emblazoned with “Tax The Rich” was all over the news and the internet earlier this week.

Take a look:

If you have some feelings about this, I understand. After all, it’s worth noting that I’d consider all of our clients to be “rich” by most objective standards: they are financially comfortable or building comfort with a plan in place, they’re lucky enough to live in this country, and they’ve built rich lives full of things and people they care about. However, in this case, Ms. Ocasio-Cortez claims to have taken aim at a definition of “rich” that is different than who our clients are. She’s talking about the billionaire class.

Regardless of whether you love or hate her message, let’s use her political statement to bring attention to some things I think are important to consider. But first let me first state that my job is not to opine on politics even though seemingly everything has gotten political — of course I have opinions and I don’t mind discussing them. But this blog is about wealth management and the investment, tax, estate planning, and economic factors which may impact people in pursuit of financial goals. My job is to help guide people through an ever-changing landscape — so when something like “Tax the Rich” goes viral, I may weigh in.

Before I get into the main body of this blog, I have a quick reminder:

Clients of Harding Wealth have a proactive tax planning meeting before the end of 2021. These discussions usually take place in November & December, but because I will have a newborn any day now I’m going to start opening up my appointment window to spread out these meetings through year-end. Clients can use this link to schedule or email me or Cinnamon directly to pick a time.

Okay, back to AOC’s dress and some things I think are worthy of our attention:

Thing #1: The Money Supply is out of control.

Our central bank continues to engage in a wide variety of unprecedented efforts to stimulate the economy, provide benefits to unemployed workers and to offer liquidity to financial institutions. Meanwhile, government revenues have fallen and we’ve instead turned to unprecedented amounts of borrowing. Pair that with a prerogative to keep interest rates low and we’re left with the Fed buying up trillions of dollars in assets—including government debt.

This has fueled new money creation.

Inflation seems to be a big worry on everyone’s mind these days, which is reasonable anytime we see significant new money creation. There is an argument to be made about much of the inflation being “transitory” (temporary) due to pent up demand accumulated during the shutdowns of 2020, along with pandemic-related shocks to the supply chain… But I think we can all clearly see that inflation as a result of more dollars chasing about the same amount of stuff is also here.

You see, most stuff becomes valuable due to it being scarce. When we think dollars this way it should really make us concerned about there being too many of them in circulation.

In fact, it’s an odd dichotomy, but the fact that dollars can be taken via taxation is one thing which helps make them scarce and, therefore, valuable.

I would have loved it if the money supply had not been manipulated as it has over the last 18 months, but the writing is now on the wall. Raising taxes and interest rates does have the potential to help preserve the value of our dollars.

Thing #2: Billionaire Wealth vs. Everyone Else

This is kind of a controversial take, but I’m going to go ahead and say it: Differences in wealth don’t really bother me.

I feel like focusing too much on wealth differences is a little like me complaining that I have to drive a Toyota Camry that runs beautifully while you drive a Ferrari. If I never knew you had a Ferrari, or if I never knew a Ferrari existed, then I would be perfectly happy with my reliable Camry. There’s always someone who’s richer to compare ourselves to, and social media makes it very easy to foster unhappiness with a current situation which may be objectively pretty great if not for trying to keep up with the Joneses (or the Bezoses).

However, what I am bothered by is whether or not our standard of living is getting better at the lower end of the wealth distribution. I’m talking about poverty rates, education, equal opportunity (not to be confused with “equal outcome”), economic mobility, general optimism, etc… As long as good relative progress is being made in that arena, I’m okay with billionaires getting richer.

With that said, here is the increase in net worth of many billionaires over the last year and a half or so.

The top 15 billionaires in America grew their wealth by more than 80% over this time period — In many ways, it was as a result of the mismanaged measures which ballooned our money supply, along with leadership’s strategy of “closing your neighborhood stores and keeping open Walmart/Amazon/etc.” which contributed mightily to the problem (5 of the 15 of the wealthiest people are Walmart or Amazon heirs or founders).

This growth of billionaire wealth wouldn’t concern me if not also paired with the growth of the money supply and national debt (Thing #1 above).

Back in June I wrote about "The National Debt” deserving a potential rebranding as “The National Investment” — but over the course of the last 18 months, that national investment has disproportionately widened the income and wealth gap without also improving the lives of those at the lower end of the wealth distribution.

I’m firmly in the camp of believing that the U.S. is a better place because we’re home to some of the most productive members of society who’ve built world-altering enterprises which have generally improved the lives of people across the socioeconomic spectrum. But with that said, the ultra-rich doesn’t need additional help from the government.

After hearing stories recently about Blackrock buying up houses at an unprecedented rate I think we can all see how large, cash rich institutions and billionaires could end up literally renting out the American Dream to the majority of the population if the playing field isn’t leveled.

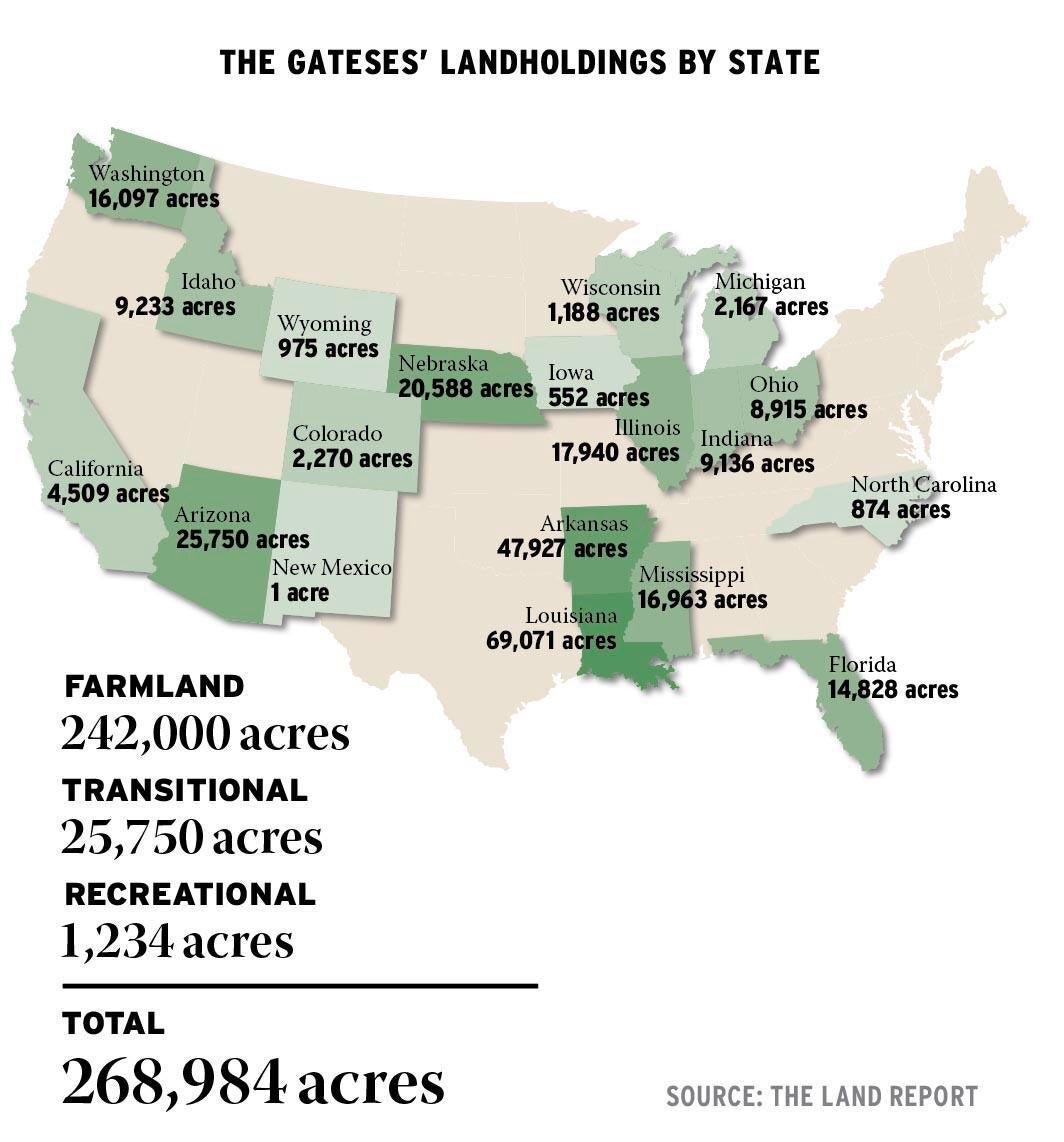

It’s not only Blackrock, below is a map of Bill Gates’ landholdings — that’s a lot of land.

Thing #3: If Taxes Go Up, What Can We Do?

With the above points highlighted, it’s worth recognizing something: it’s unlikely that tax increases, if made, would be isolated to the billionaire class.

We may see increases in income taxes, capital gains taxes, taxes on dividend income, estate tax, etc… Just this week we received some insight into democrats’ proposals to raise capital gains taxes from their current top rate of 20% up to a top rate of 28.8%. If this proposal were to go through as it’s currently authored, all capital gains realized after September 13th (3 days ago) would be taxed at the new higher rate. The new top tax rates would apply to individuals making more than $400k/yr or families making more than $450k, but it’s likely that higher rates would be standard across the board.

Unfortunately, because these bills are being proposed with retroactive start dates, we really can’t do anything about that at this point — but the good news is that high capital gains tax rates means we often don’t want to sell our investments because it would trigger a tax due. This reinforces a prudent buy-and-hold, long term investment outlook which I generally support. As Warren Buffett says, “My favorite holding period is forever.” I’ll expand on the Oracle’s take and add that up front due diligence on investment purchases is even more important if our holding periods are longer.

This does, however, maintain our vigilance for tax loss harvesting in client portfolios and it also reinforces our views that taxes are likely to rise for people whose income stays flat. In 1981 the federal income tax rate on individual filers was 70% on income more than $108,500. SEVENTY PERCENT. (for a historical record of income tax rates, click here) I don’t think we’re going that high anytime soon, but those wild numbers from the 80s are a reminder of what is possible.

So here’s the thing: if there’s one component of a long term wealth plan I can recommend that is completely insulated from all of these tax proposals, this drawing I made sums it up.

Yep, if you catch me at any Met Gala events anytime soon, I might have “FUND YOUR ROTH” stitched on my suit.

Roth IRAs grow tax free (no capital gains or dividend taxes) and withdrawals are tax free if you’re older than 59.5. Unlike a traditional IRA or 401(k) deposit, Roth contributions don’t save you money on taxes this year, but that means you’re paying the current tax rates now in exchange for not being forced to pay whatever the rates are in the future.

The only problem is that income and contribution limits can make it difficult to get money into a Roth IRA. Here are the various ways you can do it:

Contribute directly from your savings into a Roth IRA. This is the best approach if your income is below $125k (individual) or $198k (married). You can put in $6,000 per year or $7,000 if you’re above 50.

Make Roth 401(k) or Roth 403(b) contributions. There are no income limits on Roth contributions if it’s through a workplace retirement plan. Your maximum annual contribution limit is $19,500 if under 50, $26,000 if older than 50.

If you already have funds in an IRA, you can convert those over to a Roth IRA anytime. If you do so, you’ll have to claim the amount you convert as taxable income in the year you convert it. So before you go ahead and shift $250,000 or $25,000 from an IRA over to a Roth, be sure to get a professional opinion to discuss the tax ramifications of claiming that extra income before you do it; the last thing you want is a big unexpected tax bill.

If your income is too high for a Roth IRA, you could get to a Roth through the "back door." To use this strategy, you'd start by placing your contribution in a traditional IRA—which has no income limits. Then, you'd move the money into a Roth IRA using a Roth conversion. I’ve seen some rumblings about this loophole being closed, but for now it’s open for business.

Of course, there is a lot of nuance which may determine whether or not you should consider any of the above. Be sure to consult with someone (me, if you’re a client) about the intricacies of your situation before making adjustments to your tax strategy.

I know I’ve just rambled on for a few hundred words about tax increases that may or may not happen and normally I don’t like to solve problems before they get here, but I also need you to know I’m watching these developments closely.

And finally, just remember that when someone says “Tax the Rich” they have no idea what it is that actually makes you rich. They’re talking about dollars, your definition of “rich” is hopefully not just money.

Onward,

Adam Harding | Advisor | Economics Person | Amateur Artist

480-205-1743